The Lahore High Court (LHC) on Wednesday heard a petition against collection of General Sales Tax (GST) on electricity bills.

Justice Shujaat Ali Khan was hearing a petition by citizen Nasir Salman against collection of GST through electricity bills. The court issued notices to the other respondents, including the Federal Bureau of Revenue (FBR) and WAPDA, and sought their reply on August 22.

The petitioner named the Prime Minister, President of Pakistan, Chief Secretary FBR, Chairman WAPDA, Law Minister and Ministry of Information as respondents to the petition.

The public prosecutor is newly collected from small traders and retailers through electricity bills illegally. According to him, traders who do not consume a single unit of electricity should pay for it.

The petitioner said that the government’s low inflation claim has been exposed. He said that the Prime Minister is no longer ‘Sadiq’ and ‘Amin’ (honest and trustworthy).

The court also asked the prime minister to question the sharp rise in prices of petrol, gas, electricity, medicine and other essential items. The petitioner urged the LHC to set aside the orders to levy GST on electricity bills. After the first hearing, LHC Justice Shujaat Ali Khan sought response from FBR, WAPDA and other respondents.

The meeting was adjourned until August 22.

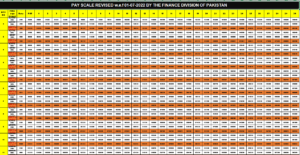

The federal government, through the Finance Bill 2022-23, has imposed a fixed tax levy on retailers through electricity bills.

Earlier, the Lahore High Court (LHC) banned the collection of Rs 6,000 fixed monthly GST on electricity bills of lawyers.

The LHC Rawalpindi was hearing a case on a petition filed by the Lahore High Court Rawalpindi Bar Association regarding the collection of sales tax from bar associations. Justice Tariq Saleem Shaikh termed the move to impose general sales tax of up to six thousand rupees on electricity bills of law firms as illegal.

The court said that the collection of GST on electricity bills is invalid and the amount should be refunded to the lawyers. The court noted that attorneys are not salesmen or salespeople subject to sales tax.